Growth in Europe is lagging, but inflation appears to be declining at a faster rate than previous forecasts. Growth in Germany and Sweden will be particularly weak.

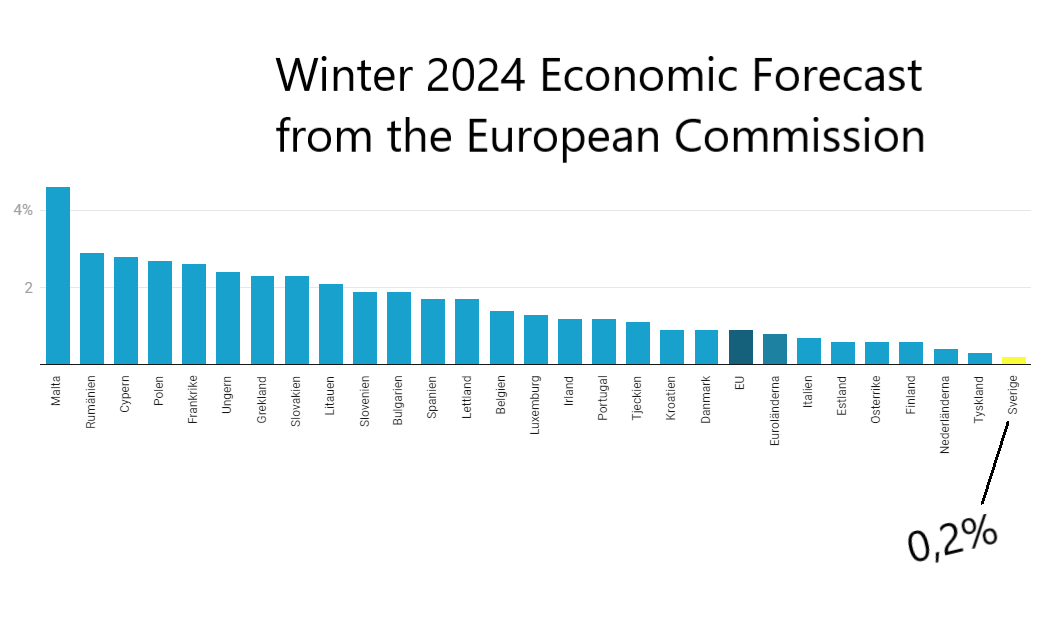

The European Commission writes down its forecast for growth in the Union once again. Despite the fact that the forecast for Sweden is slightly adjusted up, the country is expected to end up last by all member states with the lowest growth in 2024.

This appears in the European Commission’s economic winter forecast, which was presented at the end of February.

Expectations weaken to a modest 0.9 percent for all member states of the Union combined in 2024. This is a downward adjustment from the 1.3 percent that the Commission expected three months ago.

The reason is that the economy of the EU countries barely increased anything at all during 2023. Therefore, the first quarter of this year is also assumed to develop slowly. Economic Commissioner Paolo Gentiloni announced this when the commission’s “winter forecast” was presented at the end of February.

Behind the slow economic development is a decrease in exports to global markets as a result of lower demand and households having less purchasing power. This as a result of increased interest rates and inflation. In addition, the temporary national support efforts after the corona pandemic and the energy crisis have ended.

Sweden remains at the bottom

The Commission raises the forecast for Sweden, as one of the few countries. But still, Sweden is expected to end up in last place in the growth league with a growth of a paltry 0.2 percent. But the country that is usually the EU’s growth engine, Germany, is not much better. They are expected to have the second worst GDP growth in the Union.

After the sluggish start to 2024, the Commission expects economic growth to pick up in quarters 3 and 4.

The reason why Sweden may be a little better than previously predicted is that, according to the commission, households can have their purchasing power strengthened if inflation falls and with it interest rates. The Swedish people have large mortgages with short maturities, which previously reduced purchasing power more than other countries. Therefore, you can also get it back more quickly if interest rates fall.

Brighter forecast for 2025

However, the possibilities of increasing growth next year look better, even if it is still a case of historically modest increases. The reason for the cautious optimism is that the member states have reasonably strong labor markets with the possibility of increasing real wages, which together with lower inflation can make the wheels turn a little faster.

The commission also believes that continued large payments from the corona fund stimulate demand and growth.

Calculated in concrete figures, the Commission does not change its previous forecast for 2025, which means that the entire Union is expected to grow slightly higher, around 1.7 percent. But it goes at different speeds for different member states. Sweden will have recovered and be close to the average, at 1.6 percent. All while Germany continues to slow down. Together with Italy, it is expected to be last in 2025.

Faster reduction in inflation

The EU has been plagued by record high inflation, which appears to be giving way, and also doing so somewhat faster than previously forecast. The member countries pursue a tighter economic policy with the aim of not suppressing inflation. In addition, electricity and fuel prices have fallen compared to previous winters.

However, the Commission warns that energy prices may temporarily increase, and thus inflation, once various energy subsidies are phased out in the member states.

All things considered, the Commission expects eurozone inflation to remain at 2.7 percent for 2024 and 2.2 percent next year. For Sweden, which does not belong to the eurozone, inflation will be lower, a whole percentage point lower in 2024 but almost at the euro level in 2025: 1.9 percent.

Risks that can be harmful

As can be seen, there are many different factors that can mean that this winter forecast is not correct. It could be a worse development than what the commission has now presented. Economic Commissioner Gentiloni admitted that when he presented the winter forecast.

He stressed that there are serious geopolitical tensions that could overshadow European economic development.

First of all, the now two-year war of aggression that Russia is conducting against Ukraine. There is also a tangible risk that the conflict in the Middle East will expand.

There, the attacks on shipping on the Red Sea are a cloud of worry. The increased shipping costs that have so far affected Europe have a marginal effect on inflation, but if disruptions to shipping increase and create severe bottlenecks in the supply of components to European industry, it could choke production and thus cause prices to rise.

Subscribe

Subscribe